Managing money in Australia today often means juggling more than one income stream. You might have your main job, a side business as a sole trader with an ABN, and perhaps an investment property.

Trying to keep these finances separate using a single view of your bank accounts or a basic spreadsheet can be messy and confusing. You need a clear system for expense tracking to see where your money is going.

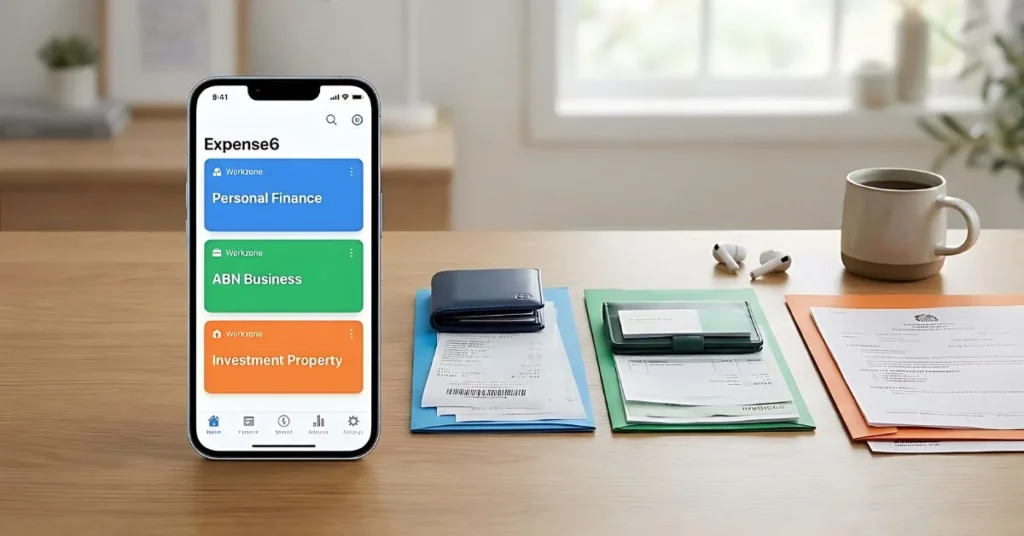

Many budgeting and savings apps offer a generic solution that doesn’t fit this mixed financial situation. They might be good for simple personal spending but lack the tools needed for a small business or managing property expenses. If you need a budget that provides clarity across every part of your financial world, you need a different kind of budgeting tool. Expense6 was designed for this exact challenge.

One App, Multiple Financial Lives: Introducing Workzones

Our solution to managing a mixed financial life is a feature we call ‘Workzones’. Think of a Workzone as a completely separate digital folder for a specific part of your life. This means you can create your budget for your personal spending, another for your ABN business, and a third for an investment property, all within the same great app.

This ability to personalise and separate your finances within one management platform provides total clarity over your cash flow. When your income and expenses are properly separated, you can make better financial decisions and improve your overall financial health. This is the app designed to give you that control and help you stay on top.

A Private Approach to Your Budget

Many budget apps available today ask you to sync your financial accounts. They require you to connect your bank accounts and credit cards directly to their platform for a real-time feed of your transactions. We take a different budgeting approach.

Expense6 does not connect to Australian banks. Instead, all transactions are logged as transactions manually by you. This method gives you complete control over your financial data and keeps you more aware of your spending habits. Your information is protected with strong encryption, and you never have to share your sensitive bank login details with a third party.

Tools Designed for Your Financial Goals

A good budget requires the right tools. Expense6 provides simple, powerful features to help you manage your money effectively and achieve your financial goals.

Master Your Expense Tracking

A good budget starts with knowing exactly where you spend your money. Expense6 gives you the tools to track every dollar effortlessly. You can instantly categorise every transaction, from a client coffee in Sydney to supplies for your investment property, and attach a digital receipt on the spot.

This process of expense tracking means no more fading receipts in a shoebox when the EOFY rolls around. You get clear financial insights into your spending habits, allowing you to make smarter decisions and find more opportunities for money saving. A clear budget is the first step to successful saving money.

Set and Achieve Savings Goals

Saving money is easier when you have a clear plan. Expense6 allows you to set savings goals and track your progress over time. By managing your budget effectively, you can allocate funds toward your savings account and watch as you grow your savings. This helps you build a better financial future.

A Powerful Tool for Your ABN and Business

Expense6 is also a powerful app for business, not just a budget app. For sole traders and freelancers, our paid version offers a full suite of tools to manage your business finances. This is available through a simple monthly or yearly subscription.

You can create and send professional invoices, track expenses for tax purposes, and manage client payments all from one place. It’s the simple management platform you need without the complexity of traditional accounting software.

What Users Are Saying: Ratings and Reviews

When choosing from the many budget apps on the App Store, checking ratings and reviews is a smart step. The feedback often highlights what users truly value. While many apps offer a free version, users often find that a simple subscription to a more powerful tool provides better long-term value for their financial situation or needs. The key is finding the right budgeting app that aligns with your specific needs.

Expense6 is free to download, allowing you to explore the features and see if our budgeting approach works for you. We are confident that once you experience the clarity of Workzones and the security of a no-sync approach, you will understand why it’s the best budget solution to help you save money and take control of your financial future.

Your Questions Answered

Here are some common questions we receive about how Expense6 works for users in Australia.

What makes Expense6 a good budget app for Australians?

Expense6 is built for the way many Australians manage their finances today. It allows you to separate your personal budget, a side business, and investment property finances all in one app. This unique structure, combined with features like invoicing and expense tracking, makes it a flexible budgeting tool for a complex financial situation.

Does Expense6 connect to my bank account?

No. We do not sync with or connect to any Australian banks. Your privacy is a priority. All transactions are entered manually, which gives you full control over your data and a better awareness of your spending habits.

How does Expense6 help with Australian tax time?

The app simplifies tax preparation. You can categorise your spending throughout the year and attach digital copies of receipts to each transaction. For sole traders and investors, this means you have an organized record of your income and expenses, making reporting to the ATO at EOFY much less stressful. It is a powerful app for business record-keeping.

Is Expense6 a free app?

The mobile app is free to download from the App Store and Google Play. This free version allows you to explore the core features. To access advanced tools like unlimited invoicing and recurring transactions, we offer a straightforward subscription.